Ever been scrolling through a finance post or chatting with a friend about money, and suddenly the term “tax deferred” pops up? At first glance, it sounds complicated like something only accountants understand.

I remember the first time I saw it on a savings brochure and thought, “Deferred? Like… delayed homework?” Turns out, it’s much simpler and way more useful than it looks.

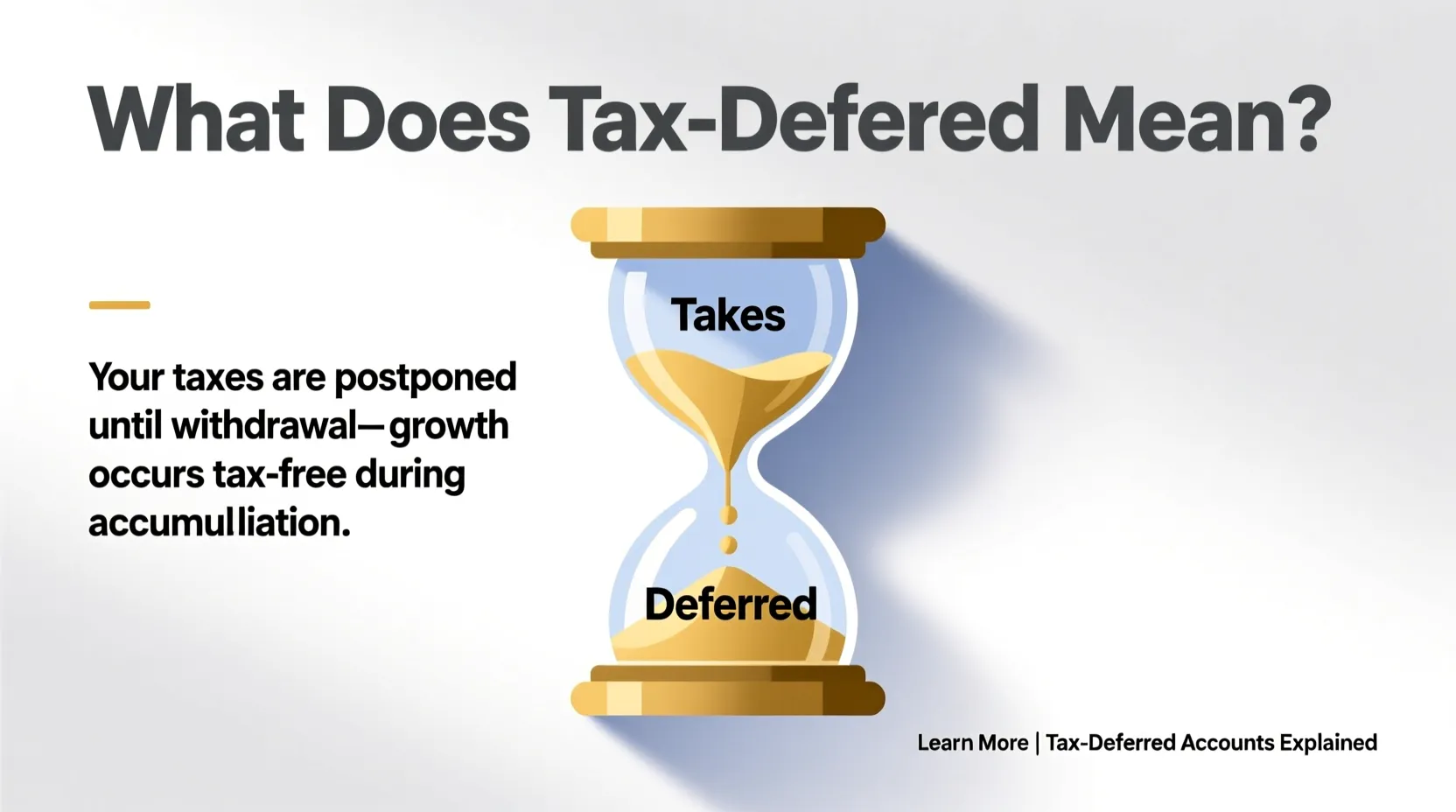

Quick Answer: Tax deferred means “taxes are delayed until later.” It’s a formal, financial term used to describe money you don’t pay taxes on right now — you pay them in the future instead.

What Does Tax Deferred Mean in Text?

In simple words, tax deferred means you don’t pay taxes on certain income, gains, or contributions right now — the taxes are postponed until you withdraw the money later.

People mostly use it when talking about investments or savings accounts like retirement plans.

Example:

“Put money in a tax-deferred account so you won’t owe taxes until you retire.”

In short: Tax deferred = Taxes delayed = Pay taxes in the future, not today.

Where Is Tax Deferred Commonly Used?

You’ll usually see tax deferred in places related to money, finance, or savings. It’s not slang, but it does show up in casual conversations about money.

Here’s where it appears most:

- 💬 Text messages about financial planning

- 💼 Work chats involving accountants or advisors

- 🏦 Bank brochures and investment apps

- 📚 Finance posts on Instagram, TikTok, or YouTube

- 👥 Conversations about retirement plans (401k, IRA, etc.)

Tone:

Tax deferred is formal, professional, and finance-related. It’s not flirty, casual slang, or internet shorthand.

Examples of Tax Deferred in Conversation

A: should i put money in a normal savings or something tax deferred?

B: tax deferred is usually better for long-term goals

A: my dad told me tax deferred accounts help with retirement

B: yep, you pay taxes later instead of now

A: is this investment tax free?

B: not tax free… tax deferred. you’ll pay later

A: what’s the benefit of tax deferred?

B: your money grows without taxes cutting into it

A: i’m confused 😅

B: think of it as “taxes postponed till the future”

When to Use and When Not to Use Tax Deferred

When to Use

✅ When talking about investments or savings

✅ When discussing retirement accounts

✅ When explaining tax benefits

✅ When texting about long-term financial planning

✅ When someone asks about “tax free,” and you want to clarify

When Not to Use

❌ Casual slang chats

❌ Flirty or friendly conversations

❌ Urgent messages

❌ Formal emails where a more precise term is needed (e.g., “deferred taxation”)

❌ Any situation unrelated to money or tax planning

Comparison Table

| Context | Example Phrase | Why It Works |

|---|---|---|

| Friend Chat | “i’m thinking of putting money in something tax deferred 😄” | Simple & casual |

| Work Chat | “This account offers tax-deferred growth.” | Professional and accurate |

| “Your contributions will receive tax-deferred treatment.” | Clear, formal, detailed |

Similar Slang Words or Alternatives

| Term | Meaning | When to Use |

|---|---|---|

| Tax free | No taxes ever | Talking about truly tax-exempt accounts |

| Tax deductible | Reduces your taxable income | Discussing tax savings for the current year |

| Tax advantaged | Any account with tax benefits | General finance conversations |

| Pre-tax | Money before taxes are taken out | Workplace payroll or retirement contributions |

| After-tax | Money taxed before investing | Comparing types of retirement accounts |

FAQs About Tax Deferred

Is tax deferred the same as tax free?

No. Tax free = never taxed.

Tax deferred = taxed later.

Why would someone want tax deferred growth?

Because the money can grow faster when taxes aren’t taken out yearly.

Is tax deferred good for retirement?

Yes, it’s extremely common because most people will be in a lower tax bracket when retired.

Do teenagers or students use this term?

Not usually. It’s a financial term, not slang.

Is tax deferred casual or formal?

It’s definitely formal and finance-focused, even when used in casual chats.

Conclusion

Tax deferred is a simple but powerful term that means you postpone paying taxes until a later time, usually when withdrawing money from an investment. It’s mainly used in financial conversations, not everyday chat slang.

Understanding this term can help you make smarter decisions about saving, investing, and planning long-term money goals.

Welcome to ReplyResponses.com, your go-to hub for quick, witty, and clever replies for every situation! Whether you’re looking to spice up your chats, craft the perfect comeback, or make your messages stand out, we’ve got you covered. From funny one-liners to smart responses, our platform helps you communicate with confidence and flair. Get ready to never run out of words again—because every conversation deserves the perfect reply!